What a difference a year makes! Following a tough year for British consumers, retailers and the meat supply chain have entered a more positive period on the home market. Here we review the situation and the opportunities likely to arise.

A split market

Following the successful start of the vaccination campaign in May, consumer confidence rose to the highest level in five years, as the country looked forward to exit the most severe pandemic in a century. However, cost of living concerns, the sight of empty shelves, increased taxation and the unending pandemic have led to a sharp fall of consumer confidence to -14 at the end of September according to IGD data. Some 85% of shoppers now expect food prices to rise next year with people on lower incomes the most concerned. The level of consumer confidence towards the end of the year is likely to be further affected by the October fuel crisis and the fast-rising cost of energy.

However, the country is about evenly split between the haves and have nots. Some 16% of adults (one in six people) across England, Wales and Northern Ireland are experiencing food insecurity according to the Food Standards Agency. In Northern Ireland, the number of households on universal credit has doubled from 57,920 people in February 2020 to 116,810 in May of this year. In total, nearly half of British households are financially challenged and are now facing a tightening of government support. At the other end of the spectrum, higher income households have accrued substantial savings worth an estimated £100 billion.

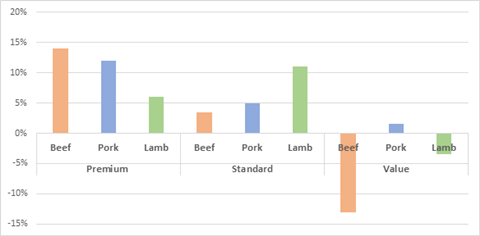

Changes in the sales of red meat (week ending 12th June)*

Therefore, meat processors supplying the retail trade or who are selling directly to the public must understand the polarisation of the market, the ‘K-shaped’ recovery and its implications for shopper behaviour. On one hand, sales at discounters are expected to rise as financially-challenged shoppers hunt for value; on the other hand, more affluent, carefree shoppers, particularly amongst older age groups will seek premium and super-premium products both for every day and special occasions. Lamb, the meat species best liked by older, wealthier consumers, is an outstanding example. According to AHDB, sales of premium meats have risen by 12.2% year on year to the week ending 12th June, with steak cuts and cooked ham the stars of the premium category. On the other hand, sales of ‘value’ beef were down 13%. The difficulty resides in the fact that 66% of premium meats volumes are sold on price promotion against 38% for standard meats.

Retail winners and losers

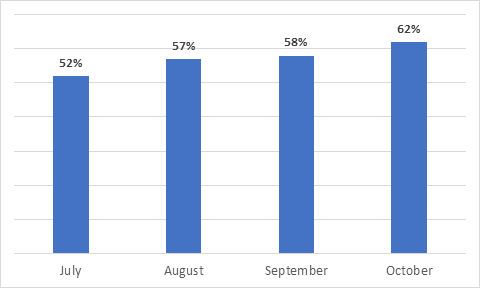

Poor product availability on the shelves due to staff and drivers’ shortage has been the greatest issue of the second half of 2021. IGD research shows that concerns are particularly high in London and the Southeast, Scotland and Northern Ireland. The joint category of meat, fish and dairy comes third in the level of concern after produce and soft drinks. On the positive side – if one can say so, only 27% of shoppers are stockpiling against 62% at the height of the first lockdown. However, this rises to 40% in London.

With deconfinement, shoppers, particularly older people, have flocked back to stores, dampening online grocery sales. Still, penetration has increased hugely in the past eighteen months and has reached 26% for the super-category meat, poultry and fish and more than 10% of meat is now sold online. Sales at specialist online retailer Ocado are up 35.9% against 2019. The reduced availability of petrol means online grocery sales have creeped back to 12.4% of the overall market.

% Experiencing poorer availability when food and grocery shopping in-store or online

Despite booming sales, supermarkets have not necessarily had an easy time due to cost pressures, shop floor staff shortages and difficulties in the supply chain. Higher wages and higher cost of raw material, packaging, equipment and logistics are likely to convert to a food price inflation forecast to exceed 5% in 2021. Currently, only Tesco (+0.6% market share to 27.5%) and Lidl (+0.4% to 6.2%) are increasing their share of the grocery market.

Cooking from scratch is still up 11% compared to pre-pandemic times according to Kantar with a positive upshot for the meat category.

Butchers are back!

High street butchers and butchers in farm shops have had a bumper 2020 as people have rediscovered the virtue of local food shopping and service during the pandemic. About half the UK population visited at least once a butcher in 2020. Butchers are attracting new, younger customers and have increased their share of the retail meat market. Queues outside butcher shops often linked to the limitation of the number of people in stores have been a revealing feature of the crisis.

Not only have shoppers flocked to butchers, they have bought about 50% more per shopping trip. So far, so good. Current data indicates that, in the first part of 2021, the gains have been maintained. Yet, any butcher will tell you: gaining new customers is one thing, keeping them is another.

Anti-meat retail stance

Although Tesco’s eye-catching goal of tripling its plant-based sales at the expense of meat sales have been the most prominent initiative, nearly all British retailers have jumped on the anti-meat bandwagon. Perceptibly, the higher retail margins of protein alternatives and the attraction of easier to handle, ultra-processed prepacked food on shelves are a boon for supermarket chains.

All major retailers bar Lidl are taking part in a project led by the Institute of Grocery Distribution (IGD) whose goal is “reducing meat and dairy (especially red and processed meat)” alongside the two other objectives of increasing the proportion of food from plant-based sources and reducing food high in fat, salt and sugar. Some large multinational food corporations with vested interests in the marketing of meat and dairy alternatives such as Alpro, Kelloggs and Nestlé form part of the group. The presence of 2 Sisters’ Food Group is puzzling as the initiative aims to reduce its sales.

As ever, no discussion nor facts are provided why meat consumption is unsustainable and unhealthy, other than the reference to the old and discredited Eat Well guide and the overly simplistic “plant-based good – animal-based bad”. For example, there is no data presented for this objective of “reducing food high in fat, salt and sugar” and only meat consumption is presented as an indicator of a healthy and sustainable diet.

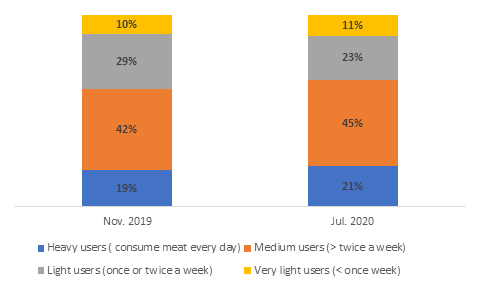

Fortunately for the meat sector, the campaign is not doing well with the organisation acknowledging that between 2019 and 2020, the proportion of people with healthy meat consumption (one must say healthy, as people regularly eating fresh meat have the lowest consumption of ultra-processed, high fat and sugary foods), the heavy and medium users, has risen from 61% to 66%. IGD states that the proportion of non-meat eaters has risen from 9% to 15% between November 2019 and July 2020. However, the survey is based on online self-reported responses that tend to overstate feel-good attitudes. Other data, for example from Kantar, do not support these figures.

Healthy UK meat sales: consumption frequency

Despite supermarkets’ push for meat fakes, shoppers are not fooled by their higher cost and poor value. Similarly, blended meat and vegetable products promoted by major retailers are most often not perceived in providing good value.

Opportunities for meat processors in the second half of 2021

Core lines will remain under price pressure to address the needs of the segment of the population feeling under economic pressure. However, these post-Covid-19 times present valuable opportunities for the meat processors to address the needs of the wealthier, older segment with lamb, premium beef, differentiated products such as duck, veal and venison, as well as a new premium processed pork offer.

The British meat sector, famed for its resilience, will now surely demonstrate its flexibility and reactivity to the new mood of the retail market.

This story was originally published on a previous version of the Meat Management website and so there may be some missing images and formatting issues.