Market research firm Kantar report a 1.8% increase in take-home grocery sales in March, which was the slowest rate since June 2024.

Grocery inflation stood at 3.5% for the four-week period ending 23rd March 2025, with take-home grocery sales increasing by 1.8% on the year over the four weeks. This was the slowest rate since June 2024.

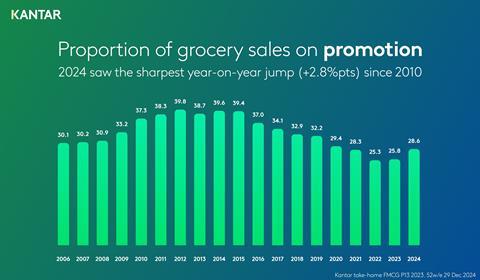

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “With prices continuing to rise, supermarkets are mindful of the need to invest to attract shoppers through their doors. Promotional sales ramped up this month to 28.2% of total grocery spending, the highest level we’ve seen in March for four years.”

Kantar said retailers’ price cuts were responsible for £2.6 billion of promotional spending, 8.8% more than the same time last year and significantly higher than the £686 million spent on multibuy deals and ‘extra free’ offers.

Fraser McKevitt continued: “Despite the recent surge, we’re still some way off the promotional records hit in the wake of the financial crisis. Average spending on deal in 2012 was 39.8%, meaning there could still be more headroom to go. However, the market has changed a lot in that time, with the discounters holding a far higher share today than they did 13 years ago.”

McKevitt added: “While the number of people reported as financially struggling has fallen from its recent peak, this still accounts for almost a quarter (22%) of the country. The rising cost of groceries ranks third on the list of concerns keeping consumers awake at night, just behind energy bills and the country’s overall economic outlook.”

Retail sales increase

Tesco boosted spending by 5.4%, with its market share climbing from 27.3% to 27.9%. Sainsbury’s reached 35 consecutive periods of year-on-year growth, increasing its market share to 15.2%.

Aldi’s market share hit 11% as its sales grew by 5.6%. Lidl sales rose by 9.1%, taking its market share to 7.8%.

Ocado was the fastest growing grocer, a position it has held for the last 11 months, as its sales increased by 11.2%. Grocery spend at M&S increased by 13.1%, on top of M&S goods sold through Ocado.

Sales at Morrisons were 0.6% higher and its stake of the market stands at 8.5%. Asda holds a 12.5% share. Spending through the tills at Waitrose grew by 2.7%, maintaining its 4.4% share of the market. Take-home sales at the Co-op were up by 1.0% with the convenience retailer now holding a 5.3% share. Iceland’s hold of the market is 2.2%, and its sales increased by 1.8%.