A treat-filled Christmas is on the cards this year for consumers despite price rises, according to market research company Kantar.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: "Preparations for the festive period are in full swing. As we count down on our advent calendars to the big day, it’s clear that shoppers want to have some fun and make this Christmas extra special. Price inflation doesn’t seem to be denting their desire to treat themselves and loved ones, and supermarket premium own-label ranges, such as Tesco Finest and Asda Extra Special, are the fastest growing ranges in store. Last December, we saw sales of premium own-label lines hit more than £587 million, and the figure could be even bigger this year.

“However, take home grocery sales fell by 3.8% over the 12 weeks to 28th November 2021 compared with 2020 according to the latest figures from the organisation. Despite this, sales remain strong compared with the market before the pandemic, and grocery spend was 7% higher in the latest 12 weeks than in 2019."

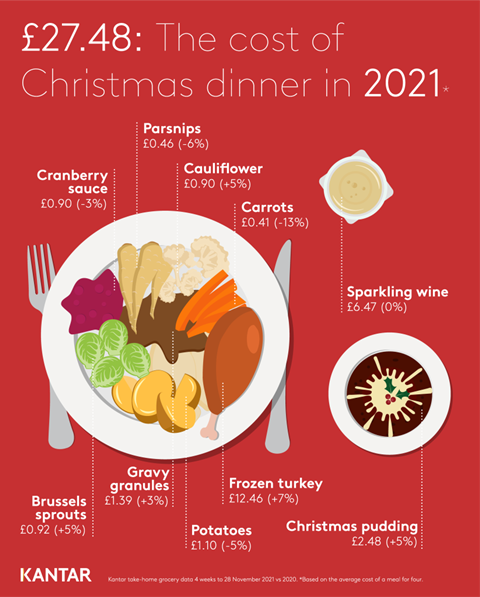

He added: “Inflation is already nudging up the price of Christmas dinner staples. The average cost of a meal for four is now £27.48, that’s an increase of 3.4% compared with last year. Across the board, grocery prices are up 3.2% in the latest four weeks, the highest rate of inflation we’ve recorded since June 2020. Consumer behaviour hasn’t caught up with these changes though. Habits we’d expect to see shift, like swapping branded products for own label or seeking out promotions, haven’t altered just yet.”

Mixed fortunes for retailers

While Kantar report that all the retailers achieved growth compared with pre-pandemic in 2019, year-on-year grocery sales were down across the board. Tesco’s sales fell by 1.4%, a softer decline than the total market. The grocer won 0.7 percentage points of share this period, the retailer’s biggest jump over 12 weeks since 2007, taking it to its highest market share since February 2019.

Lidl and Aldi also made share gains over the past 12 weeks. Both limited their annual sales decline to just 1.1%. Lidl hit a new record market share of 6.4%, while Aldi won 0.2 percentage points to move to 7.9%.

Sales at Ocado fell by 2.4% year-on-year but have grown by 35% compared with two years ago. It boosted its market share from 1.7% in 2020 to 1.8% in the past 12 weeks. Sainsbury’s now holds a 15.4% share of the market, Asda 14% and Morrisons 10%. Waitrose’s market share was steady at 4.9%, while Co-op now stands at 6.1% and Iceland at 2.3%. Independent and symbol retailers saw sales fall by 10.5% but remain in growth compared with 2019.

McKevitt highlighted that recent concerns over the next stage of the pandemic may see consumers change the way they shop over the next few weeks.

“Our excitement about Christmas this year has been slightly tempered as news of the Omicron COVID-19 variant has emerged. Online grocery sales fell by 12.5% in the four weeks to late November, as we compare against more orders last year during the second lockdown. As concerns grow over rising case numbers, we expect some people will prefer to shop online again to limit their visits to stores.”

This story was originally published on a previous version of the Meat Management website and so there may be some missing images and formatting issues.