Christmas 2025 will see tradition blended with modern convenience, the Agriculture and Horticulture Development Board (AHDB) has predicted, with turkey to remain the protein of choice for those celebrating.

AHDB found that 80% of consumers who celebrate Christmas are planning celebrations that are the same size, if not larger, than Christmas 2024.

Charlotte Forkes-Rees, retail and consumer insight analyst at AHDB, said festive meals will continue to be a “central focus” for Christmas budgets: “Despite nearly half of consumers planning to cut back on overall Christmas spending, food remains a ‘protected spend’ in the eyes of consumers, similar to children’s gifts and Christmas trees.”

AHDB said that despite “ongoing inflationary pressure and price rises” dampening demand throughout the year for beef and lamb, they are maintaining their demand for Christmas year-on-year.

The trade body said consumers appeared “ready to prioritise taste and tradition” over budget constraints, with 68% of consumers planning on “doing what it takes” to enjoy Christmas (Sparkminds, November 2025), as well as claiming great taste and high quality are the most important factors they consider when purchasing meat for Christmas Day (AHDB/YouGov, November 2025).

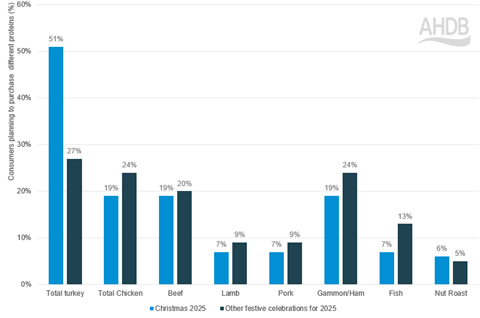

It went on to report that 75% of consumers plan on having at least one or more celebratory meals over the festive period outside of Christmas Day itself, and the majority of these will be in home (AHDB/YouGov, November 2025). During these occasions, turkey is predicted to play a smaller role, with beef, lamb, pork and gammon increasing their share on plates (AHDB/YouGov, November 2025).

AHDB observed that for retailers and processors, this suggested shoppers may look for something more special than their usual purchases and for longer than just the week leading up to Christmas. It also found that consumers were open to shopping around for meat purchases, with 13% claiming to be planning to purchase meat for Christmas from an alternative, more expensive retailer (AHDB/YouGov, November 2025), with premium retailers and butchers likely to gain share of meat sales.

Convenience is also set to play a bigger role, said AHDB. With one-fifth of consumers reportedly finding Christmas cooking stressful, and those aged 18-34 especially keen on preprepared proteins, AHDB anticipates a rise in demand for ready-to-cook and sous vide options that aim to save time without sacrificing taste and quality, despite the associated higher price tag.

AHDB said that social media interest earlier in the year over £195 beef Wellingtons, and continued reliance of consumers on air fryers for cooking meals - with 41% of consumers anticipating they will use one for cooking at least part of their Christmas dinner - will likely have shoppers looking to pick up ready-prepared dishes to alleviate the pressure on Christmas Day chefs.